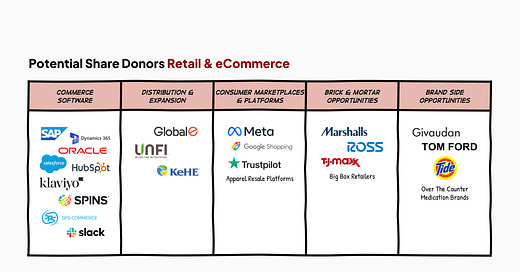

Share Donors in Retail & eCommerce

Incumbents poised to cede market share or be disrupted by new upstarts

Over the last few weeks, I shared a series of posts signaling opportunities and industry shifts across the retail & eCommerce space. For the final installment in this series, the experts were asked to share any companies they felt were ripe for giving up market share in the coming years.

From their responses, we’ve compiled a list of Share Donors below – companies that could be good targets for new startups to go up against. I’ve included commentary on why the experts believed these companies may be vulnerable below.

These are not meant to be predictions of who will lose market share, but rather indicators of where opportunities may exist for builders and investors looking at the space. It’s worth noting that each of these are sizable players that have built robust offerings and protective moats over time (to varying degrees). However, given some of the shifts in the market, some of these moats may now be eroding.

Check out the list below and if you feel like we’ve missed any, leave a comment or email us!

Are you an industry insider or tech operator with an interest in advising or angel investing in transformative startups? Consider joining our Startup Expert Squad

A huge thank you to Marshall Porter (GP at AlleyCorp; ex-US CEO at Gympass, CSO at ShopRunner), Tehmina Haider (Partner at L Catterton; ex-Chief Growth Officer at Harry’s), Adrian Alfieri (CEO at Verbatim; Angel), Alex Malamatinas (Founder of Melitas Ventures), Brian Sugar (MP @ Sugar Capital; Founder of POPSUGAR), Chaz Flexman (CEO at Starday Foods, Angel), Chelsea Zhang (Principal at Equal Ventures), Jodi Kessler (Venture Partner at 3L Capital), Jordan Buckner (Founder of Foodbevy & Joyful Co.), Qasim Mohammad (Director at Wittington Ventures), Sib Mahapatra (CPO at Branch; Angel), Simran Suri (Investor at Maveron), Sophia Dodd (Investor at Equal Ventures), and Yuriy Dovzhansky (Partner at Visible Ventures).

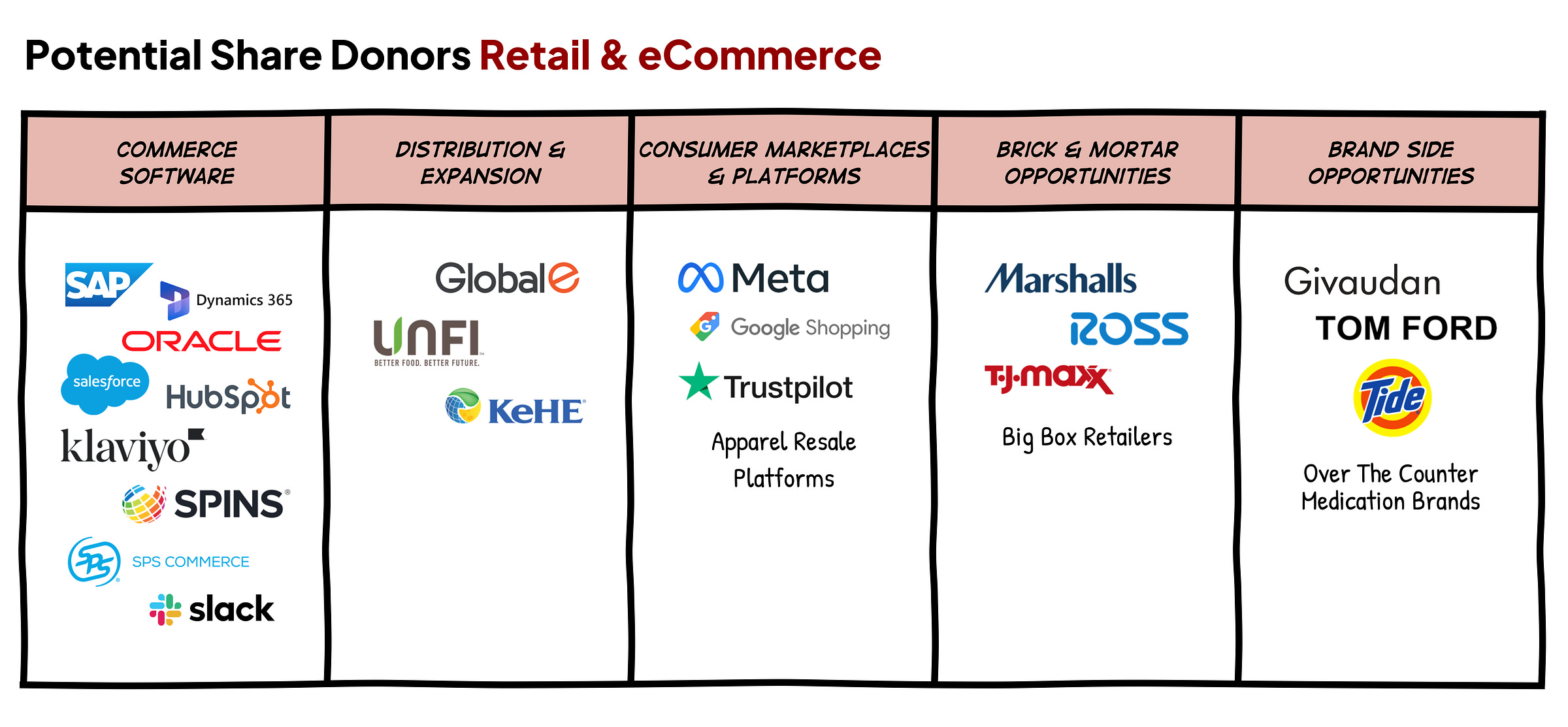

Potential Share Donators

Retail Enablement Solutions

Legacy ERPs – Oracle, Microsoft Dynamics, & SAP

ERPs serve as a core backbone of the retail industry’s tech infrastructure. ERP spend by retailers was estimated to be over $10B in 2023 and expected to nearly triple by 2032. The top 10 ERP systems in the retail industry are all owned by three companies – Oracle, Microsoft Dynamics, and SAP.

I can't think of any other category of software where the front runners are still 20-year-old offerings… the integration costs are massive and the success rate is pretty low. By success rate, I mean does the ERP solve the tangible stories that were instrumental in you scoping it? We've talked to other brands that are bigger and the answer is usually no, it didn't fully solve it.

The UX we've demoed is pretty old school. The workflows still feel a bit constrained. And so if we're paying all this money to effectively build custom business process tooling for our company, if we’re building the OS for Branch, why isn't the whole experience better?

And why do we need to pay for the whole buffet when we only want one dish to start? Why aren’t eCommerce ERPs more like Rippling? Where you can onboard a component of an ERP when you need it, and continue to onboard new components as you need them and have them all work together seamlessly.

That, to me, is the dream. The Rippling of ERP… we should be able to pick up the inventory management platform now and the order management platform and then later add the forecasting module and later add the finance module. And they all talk together as soon as you add them. Paying for what you use, not having to pay for this giant monolith when you only need 40% of it, and having the whole experience feel clean and modern for our team.

– Sib Mahapatra, Co-Founder of Branch

CRM Systems for Marketing (Hubspot & Salesforce)

Customer Relationship Management systems enable businesses to manage customer interactions, improve engagement, and enhance customer satisfaction effectively. The CRM industry in the retail space was estimated to be $15.4B in 2024. The industry is primarily dominated by cross-industry players like Salesforce ($272B market cap*) and Hubspot ($31B market cap*).

I'd say the CRMs – HubSpot and Salesforce – especially from a marketing lens [are ripe for disruption].

The reason we work with HubSpot and a lot of people do is because they think they have integration risk. Then at the end of the day, they're really just using [a few select modules] and then maybe they send emails on it. And so people go with the incumbents because they're worried but at the end of the day, they really just want something that's cleaner, easier to navigate and significantly faster, ideally with some AI built in…

I was just talking to a prospect who came to us, and they built their site on HubSpot but the HubSpot CMS is unusable. It's ridiculously hard to use, and people just don't want to touch it. And so they build on Webflow, Framer, or something else. The email capabilities in Hubspot are brutal. You can't design on the thing. You have to hire a separate HubSpot designer to go through HTML. So it's like Figma to HTML to HubSpot. If you have to pull in freelancers and contractors to just build stuff on a platform, it usually means that something is broken. And so I think there's a lot of opportunity within CRM disruption.

– Adrian Alfieri, CEO at Verbatim

Klaviyo

Klaviyo ($11.1B market cap) is a marketing automation platform that enables businesses to manage email, SMS, and push notification campaigns.

I think Klaviyo has been pretty stagnant from a feature perspective. I just haven't found that they've been adding a ton of value horizontally.

Why is their SMS capability so much worse than Attentive? Why do I need Klaviyo and Attentive? Why isn't there one super app that does both perfectly? There are synergies that arise from that because of the combined flows and data sharing. And you can hack it all together. It's definitely possible to do with separate tools. I’ve found them on the marketing side to be pretty slow – they're not shipping crazy fast and they're getting more expensive.

An underlying thesis that’s related here is around how you rebuild MarTech with generative capabilities at the forefront. Why isn't Klaviyo saying, “Here is your store, and I've generated an optimal six-email sequence for this specific abandoned cart.” And then doing the segmentation and doing the messaging.

– Sib Mahapatra, Co-Founder of Branch

SPINS

SPINS is a data and analytics provider with a particular focus on the wellness industry. It offers insights into consumer trends, product performance, and market opportunities by aggregating data from over 108,000 retail locations across channels like natural, regional, conventional, and specialty stores.

I'd like to see data more accessible and more granular… One of the things that we have been talking about a lot internally and in particular with our portfolio companies, is how AI is going to change search and customer acquisition. Because typical SEO strategies may not actually be effective anymore. And so marrying that with the data that you would get on SPINS to figure out how to help these long-tail brands scale more efficiently is important. Companies like SPINS and Nielsen just have such a hold on the market and it's been really tough for new entrants to break in and scale. I'd love to see someone actually be able to do that…

There's one thing in particular – I think having extremely localized data is really, really important. Especially now considering how spending patterns and habits might change with the election and all the policies that a Trump administration would bring. In Tribeca for example, you can get your groceries at Trader Joe's, you can get your groceries at Whole Foods, you can get your groceries at Target. It's very different demographics that go to all three. How does that change how a brand should be structuring their go-to-market strategy, their pricing, their marketing, their messaging, all that? We’d love to see a little bit more of that [granularity].

– Simran Suri, Investor at Maveron

EDI System Providers

EDI companies like SPS Commerce (~$5B market cap*) enable brands and merchants to speak with their trading partners like retailers.

These companies have tailored their offerings to work well for retailers but have proven challenging partners for brands. Many brands report being subjected to excessive fees and complex, costly integration processes. Despite widespread dissatisfaction among their customer base, these companies' strong market position and entrenched relationships with retailers make them a formidable segment to disrupt.

I do think SPS is generally in a very strong position. There is a key pain point there. But the pain point is not from the segment of the market that has any power. The pain point is with the brand, and the brands don't have any power. I would still do something there, but if I had to guess I would say SPS is going to be fine in five years. Because even if it's like the shift from EDI to API, SPS can just do APIs. And they are also big enough where they can buy fairly easily. So strategically speaking, even if the product sucks, I think they have a lot of paths they can go down to defend the market.

– Chelsea Zhang, Principal at Equal Ventures

We're just starting in wholesale, so we're pretty new to it. We've been pretty surprised by the stickiness of traditional integration methods like old-school EDI providers. You kind of don't have much of a choice as even a mid-sized brand. You have to work with what your retail partner has. I don't think this is a technology issue. It's more a market penetration issue, and there are platforms like Shopify which may be better positioned to innovate there than point disruptors.

– Sib Mahapatra, Co-Founder of Branch

Slack

Slack is one of the leading collaboration and messaging platforms used by companies across sectors. However, the interface and ways that it is leveraged can create challenges for many.

A personal beef that I have is with Slack. I wake up in London time now to 30-40 different messages and threads that are constantly getting lost. You can't mark them done easily versus on Superhuman or even just if you're using Gmail. There is an endpoint in mind and I think on Slack there isn’t one and it drives me absolutely crazy.

…On email, it's pretty easy to unsubscribe from things, shift things to different boxes, or so forth. You can pull in an E.A. to take things out where if someone tags you in a thread, even if you mute the channel on Slack you're still getting tagged and then you get constantly distracted and pulled between things. It is just a highly inefficient way to do work and it's very frustrating.

– Adrian Alfieri, CEO at Verbatim

Distribution & Expansion

Global-e

Global-e (~$6.5B market cap*) is a software and solutions provider that enables merchants to expand their global footprint and sell their products overseas. Over the past decade, the company has purchased many of its competitors to become the leader in cross-border expansion for merchants.

[At Gilt] we initially launched Borderfree (owned by Global-e) as the enablement tool and the conversion rates were just abysmally low because what you had was a global product that was designed for local audiences. And those just don't match. You can't have a product that doesn't accept Chinese characters in the shipping. You can't have a product that you can't search in or has no payments for local audiences. It got better over time, but one of the big unlocks for us was that we brought China in-house. We took it off Global-e and started to serve it ourselves with our own logistics, our own payments… and our conversion rates tripled and the business more than tripled, quite literally overnight. And so that became a $50 Million dollar business in a hurry. Despite no marketing spend.

…Fast forward to today, Global-e has sort of rolled up the entire space. Global-e bought Borderfree. They bought Flow. They're the dominant player. They have 1600-1800 different customers from brands or influencers now. And it's still a global product trying to serve local solutions. They're adequate at serving Canada, Australia, or Europe, but when it comes to countries that are uniquely different in the experience and what those customers expect, they just don't work. And so I was talking to a brand that had 7,000 visitors from China and of those 7,000 visitors they had one transaction. That doesn't make any sense on any mathematical level…

And then you talk to a retailer today using the Global-e platform, they're all at 1% [conversion]. And so we think there's a 10-20% opportunity here [for conversion] if you can deliver the right experience. Cross-border that meets what those customers want. That's exciting. And when you think about if paid marketing doesn't work and if you're struggling to find growth channels domestically, there's a whole green field internationally. But you have to deliver the right experience to really realize that opportunity.

…It actually creates headwinds for everybody. So what happens is, when Global-e is converting at sub 1% – way below 1% – the marketing dollars stop flowing there. The product team stops to prioritize it. And to this day, if you go to Macy's.com the option to choose your country is below the fold in a sub-nav in the bottom left because it's been so deprioritized as a laggard in terms of business performance that it's an afterthought. I think that's sad when our experience says this can be 20% of your business. It can be a real driver. And at the scale of a Macy's, you're talking about an enormous amount of revenue.

– Marshall Porter, GP at AlleyCorp

KeHE & UNFI

UNFI ($1.6B market cap*) and KeHE are leading wholesale distributors in the natural, organic, and specialty food markets. Both serve over 30,000 retailers across North America. As the largest distributor in the space, UNFI boasts an expansive catalog of over 250,000 products, while KeHE focuses on fresh and innovative products.

I’d love to see disruption among the larger distribution companies and retailers that hold significant leverage over smaller brands. There’s room for innovation to create a more equitable ecosystem where emerging brands can grow without the burdens of excessive fees and opaque practices.

– Jordan Buckner, Founder at Foodbevy and Joyful Co.

There are businesses that have tried to disrupt the distributors in the food industry – the KeHE’s of the world – and they found it challenging because it's hard to disrupt this system. But there would be some clear benefits to digitizing that, particularly from connecting emerging brands to some of these retailers.

– Alex Malamatinas, Founder of Melitas Ventures

Consumer Marketplaces & Platforms

Meta & Google (for Retail Ad Spend)

Now is sort of the moment and I think a lot of eyes are on Meta and Google because I think there's a huge opportunity to maybe not disrupt – I don't think those two platforms are going anywhere – but maybe take some share. And we've seen it.

We talk to brands all the time, we talk to agencies. Ad budgets are shifting away from those two platforms to creators. I think the definition of influencer has evolved tremendously and will continue to play an important role in commerce. We've seen a couple of companies that are building for this next generation of influencer referral-driven commerce, and I think there's a ton of room to take market shares from those two.

– Jodi Kessler, Venture Partner at 3L Capital

Google Shopping

[Editor’s Addition]

Despite generating over a billion searches each month, the product search and discovery functionality on Google Shopping leaves a lot to be desired.

There seems to be a massive opportunity for new AI-powered shopping engines to emerge that can help users find the best brands and products for their specific preferences. The latest AI tools can pull in a lot more context on products through images, product information, and reviews. Coupled with some of the other capabilities of Gen AI tools there should be an ability to create a new wave of shopping experiences – with semantic search, improved image search, and potentially even custom product development.

Although Perplexity has a product here, there will likely be an opportunity to reinvent the search and discovery experience with purpose-built applications geared toward shopping and brand discovery.

Apparel Resale Platforms

The global secondhand apparel market was estimated to be $230B in 2024, and is anticipated to grow to $350B by 2028. Within the U.S., the biggest players include Poshmark, The RealReal, ThredUp, Mercari, and eBay.

Existing resale models have struggled to find ways to effectively distribute value across the multiple participants in the resale value chain. Intermediaries struggle to make unit economics work. Think about it this way: you’ve got a pair of pants that is worth a specific amount today on the resale market…if the pants get sold, what are the required transaction costs, from seller acquisition to buyer acquisition to sorting to photography/merchandising and shipping? How much value goes to the seller? The intermediary that facilitates the sale? How do you make this work for lower-value items when many transaction costs are relatively fixed per item?

Winning models will have to find ways to build an approach that unlocks adequate dollars on lower-cost items, whether via advantaged ways to unlock supply and/or demand, automate item processing and/or more novel approaches to access profit pools beyond the obvious. We’re starting to see emerging players get traction here, and we remain bullish on opportunities to invest in the space.

– Tehmina Haider, Partner at L Catterton

Trustpilot

Trustpilot is an online review platform where consumers can share ratings and feedback about businesses they've engaged with. The company sees over 50M monthly visitors, generates over $150M in annual revenue, and has over 900 employees.

No one has really nailed excellent social proof and reviews. What is the next-gen Trustpilot? Why are we all still appending Reddit to find reliable product reviews? Onsite reviews won’t solve this. It has to be an extension that sits above the retail experience and your friends use it and everyone uses it and you can see exactly what your friends say about X, Y, Z product or your friends of friends.

– Sib Mahapatra, Co-Founder of Branch

Brick & Mortar Opportunities

Big Box Retailers

Big-box retailers are large-scale retail establishments characterized by their massive physical size, typically occupying more than 50,000 square feet of retail space. These stores are designed to offer a wide variety of products under one roof.

I think the big box retailers are really kind of falling flat. You're seeing it in the financial performance. I think that there's just been very little innovation around there. And I think that the consumer is looking for a new way to engage with physical retail given that now we spend so much of our time online. I certainly wouldn't be upset to see a new kind of retail experience…

There are some instances like if you look at The Nordstrom on 57th street in New York. They've done a good job of having a little bit more curation, some more in-store experiences for customers, and layering in things like resale. Trying to add more of what the customer is looking for when they're out and trying to discover brands. And bringing some of those online desires and the way that we're transacting into the physical world.

– Jodi Kessler, Venture Partner at 3L Capital

Off-Price Retailers (TJ Maxx, Marshalls, & Ross)

Off-price retailers like TJ Maxx ($130B market cap*), Marshalls (owned by TJ Maxx), and Ross ($41B market cap*) sell branded and designer merchandise at significantly discounted prices. One of the major ways they source cheap inventory to pass on savings is by taking on excess inventory from other merchants.

Historically, brands really had only a number of ways to liquidate their inventory, and it was through off-price retailers or selling to emerging markets around the world on a per-pound basis. Now there are many more. There are a rising number of promising digital liquidation channels that I think could take some of that market share away from the legacy off-price partners.

– Yuriy Dovzhansky, Partner at Visible Ventures

Brand-Side Opportunities

Fragrance Brands

The global fragrance market is valued at over $50B globally. Givaudan is one of the market leaders, with over $7.6B in annual sales. Meanwhile, Tom Ford’s eponymous label did >$800M in sales in 2022 across products, with fragrance being one of their largest categories.

The Givaudans of the world and the Tom Ford's and sort, they cater to my generation and my parents’ generation. There's an opportunity for fragrance brands and companies that appeal to Gen Z and Gen Alpha both in terms of being cleaner label but also in terms of the branding, positioning, and maybe price point.

– Alex Malamatinas, Founder of Melitas Ventures

Over-The-Counter (OTC) Health Products

The OTC drugs market in the U.S. accounts for over $36B in annual sales. Most of the leading brands in the space are owned by incumbent pharma giants like Johnson & Johnson, Pfizer, Bayer, and P&G.

The traditional dietary supplement/OTC area is fairly underinnovated for reasons that mostly make sense. True OTC products are regulated by the FDA monograph, making product innovation fairly difficult, and given merchandising is traditionally done by need/ailment, it’s not easy to build a cross-category brand.

That said, these aisles stick out as under-innovated relative to VMS, beauty, deodorant and others. We are starting to see brands innovate despite regulatory barriers–whether it’s by offering cleaner labels, e.g, removing dyes and additives, offering BFY and BFP packaging formats like glass, or building more approachable brands. The bar for success remains high, but we think it’s an area worth monitoring.

– Tehmina Haider, Partner at L Catterton

Laundry & Cleaning Brands (ex. Tide)

The laundry detergent market in the U.S. was valued at over $11B in 2023. Tide is the leading brand in the space – accounting for about 1/5 of all sales and with estimated revenues of over $2.4B.

With total respect to Procter & Gamble, it's one of the best managed companies in the world, but there's an opportunity to introduce cleaner labels and more modern laundry detergent brands. More broadly, I think there's a new wave of innovation emerging within household cleaning products.

– Alex Malamatinas, Founder of Melitas Ventures

* Market caps accurate as of March 13, 2025

A massive thank you to everyone that contributed

Marshall Porter is a GP at AlleyCorp where he leads the Diversified Technology team. AlleyCorp invests across sectors and stages but has a particular focus on companies from Pre-Seed through Series A. Marshall was previously US CEO at Gympass, President of Spring, CSO at ShopRunner, and GM & SVP at Gilt Groupe.

Tehmina Haider is a Partner focused on consumer investing at L Catterton. Founded in 1989, L Catterton is the only global private equity firm focused on consumer growth investments. L Catterton has made over 275 investments to date, leveraging deep category insight, operational excellence, and a broad network of strategic relationships to help build many of the world's most iconic consumer brands. Tehmina was previously the Chief Growth Officer of Harry’s Inc.

Adrian Alfieri is the Founder & CEO at Verbatim. Verbatim is a growth agency that specializes in generating demand through best-in-class content engines. Adrian is also an active angel investor.

Alex Malamatinas is Founder of Melitas Ventures. The firm invests in early stage (Seed and Series A) opportunities with a primary focus on better-for-you branded consumer products.

Brian Sugar is Founder & Managing Partner of Sugar Capital. Sugar Capital invests in seed-stage companies at the intersection of technology and commerce. Brian was previously the founder of POPSUGAR.

Chaz Flexman is Co-Founder & CEO of Starday Foods. Starday is leveraging an AI-driven approach to building the next great food conglomerate. Prior to Starday, Chaz was a part of the founding team of Pattern Brands, VP at PCH International, and a Partner at A16Z.

Chelsea Zhang is a Principal at Equal Ventures, where she leads the firm’s focus on retail & supply chain investments. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Jodi Kessler is a Venture Partner at 3L Capital, a growth equity firm backing companies across Commerce, Enterprise Software, and tech-enabled services. The firm typically invests in companies after Series B and writes checks of $10-30M.

Jordan Buckner is the Co-Founder of Foodbevy and Joyful Co. Foodbevy is a leading community for emerging F&B founders to navigate the complexities of growing a brand. Joyful Co. develops gift boxes that connect people through thoughtful, high-quality products.

Qasim Mohammad is a Director at Wittington Ventures focused on venture investing. Wittington is the private family office of the controlling shareholder of some of Canada's largest businesses across retail, real estate, and more. He runs a publication called Fire Ant focused on the future of commerce.

Sib Mahapatra is Co-Founder & Chief Product Officer at Branch. Branch makes it easy for teams of every size to create an office they’ll love – from ordering and assembly to space planning and pickup.

Simran Suri is an investor at Maveron, an early-stage Venture Capital firm focused on investing in consumer businesses. Maveron writes checks of up to $10m with a sweet spot of investing in Series A rounds.

Sophia Dodd is an investor at Equal Ventures, where she takes a generalist lens to investing. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Yuriy Dovzhansky is a Partner at Visible Ventures. Visible invests in early-stage companies that make the everyday extraordinary, with a particular focus on 3 verticals: eComm Software, Healthcare, and Consumer AI.